It’s been a year and three months since Block Inc CDI (ASX: SQ2) shares debuted on the Aussie share market. Yet, the fruits of engulfing the former high-flying buy now, pay later golden child, Afterpay, have not manifested in the form of a higher share price.

Oddly, the unrewarding share price performance corresponds with an all-time high in 12-month trailing revenues as of 31 March 2023. With the Block share price nearing its 52-week low again, there’s a good chance Block is beginning to catch the attention of some investors.

As they say, a picture is worth a thousand words. That’s why I believe there are five images worth viewing before making a call on Block shares.

What is the investment case for Block shares?

Every investment should be backed by clear justification. Without a doubt, Block is competing in a crowded arena. Not only that, it’s engaging in a battle of David and Goliath proportions, taking on the largest financial institutions in the world.

So, what’s the reasoning behind Block potentially succeeding in the long run?

Going global

Although Block (formerly Square) generated US$18.56 billion in revenue for the 12 months ending 31 March 2023, its revenue by geography remains highly concentrated in the United States.

According to data sourced from its 2022 annual report, approximately 93% of all revenue was derived from the US. However, the use of digital payments and the expansion of e-commerce is not a US-only phenomenon.

In my opinion, the lack of market penetration into countries outside of the US presents an opportunity to fuel future growth. Few traditional banks provide banking services across multiple countries, offering a unique chance to build a formidable cross-border brand in financial services.

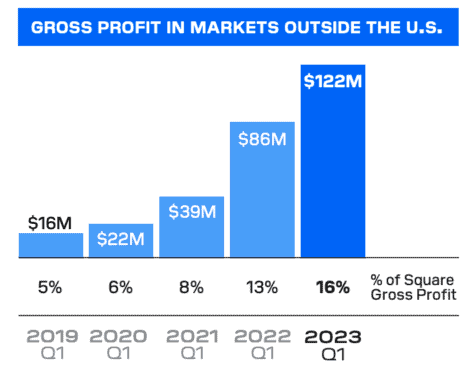

Fortunately, Block is already laying the groundwork beyond its local borders. The fintech giant grew gross profits outside of the US from its Square operations by 43% year on year to US$122 million.

Already, the company offers its payment provider services in the United Kingdom, Ireland, Canada, Australia, and Japan.

However, it’s the company’s consumer-facing product that I believe could be the biggest boon for Block shares.

A 21st-century financial operating system

Much like how Apple Inc (NASDAQ: AAPL) and Microsoft Corp (NASDAQ: MSFT) unlocked the full potential of personal computing to the masses through the introduction of user-friendly graphical user interfaces (GUIs), Block could do the same in the financial and banking services industry.

Democratising digital solutions for small and medium-sized businesses through Square could reduce the barriers of entry for many aspiring business operators. By providing a system to simplify administrative tasks (bookings, inventory management, and payments), business operators can focus on core operations.

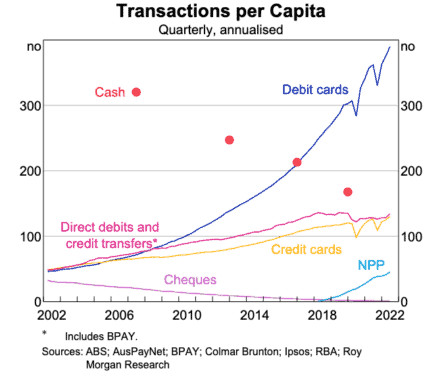

Meanwhile, Block’s Cash App ecosystem is a modern answer to money handling. The decline of cash as a payment method continues, as illustrated in the Reserve Bank of Australia’s chart above.

For many, cash has become a burden with too many friction points compared to digital alternatives. It also can’t be used for online transactions, which are becoming all the more frequent.

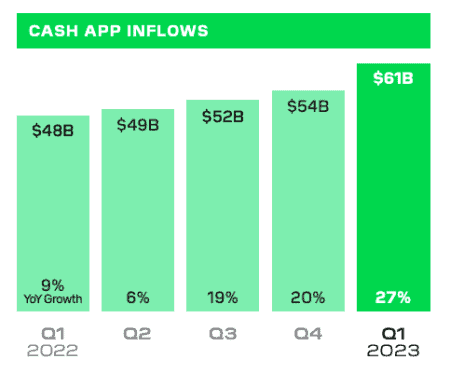

While only available in the US and the UK right now, Cash App continues to experience rapid growth. In Q1 FY23, Cash App inflows increased 27% year on year to US$61 billion — pictured below.

The impressive growth of Cash App at scale is likely to appeal to anyone considering Block shares. This area of the business could sustain double-digit expansion for many years, given the tailwinds for further digital payments adoption.

What about the valuation?

It’s one thing to have a good growth story… it’s another to be trading at a valuation worth buying at. No matter how good the future is, if all of it is priced in (and then some), the potential for upside is likely limited.

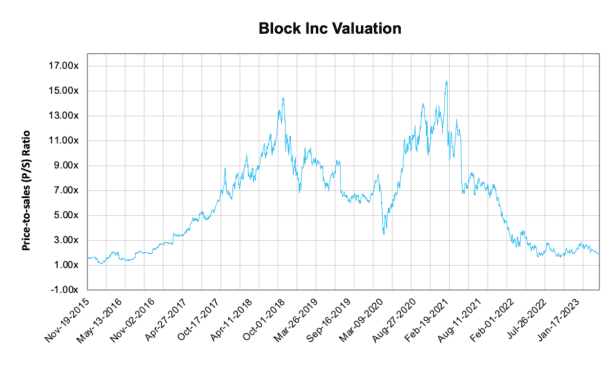

Due to Block’s checkered history with profitability, the price-to-sales (P/S) ratio is a more suitable tool for some fundamental analysis.

On this basis, Block shares are trading at their lowest multiple since early 2017. The company is valued similarly to Tyro Payments Ltd (ASX: TYR) at a P/S multiple of around two times, as shown below.

For reference, Block’s revenue has increased by nearly 11 times since late 2016. Nevertheless, the market appears unwilling to pay a greater premium while profitability proves to remain elusive.

Why I’m still a little cautious about buying more Block shares

The market opportunity to become a household name in banking and financial services across the globe is an enticing prospect. However, Block shares are not without their thorns.

Any good investor should be aware of the uglier aspects of a business before committing to investing.

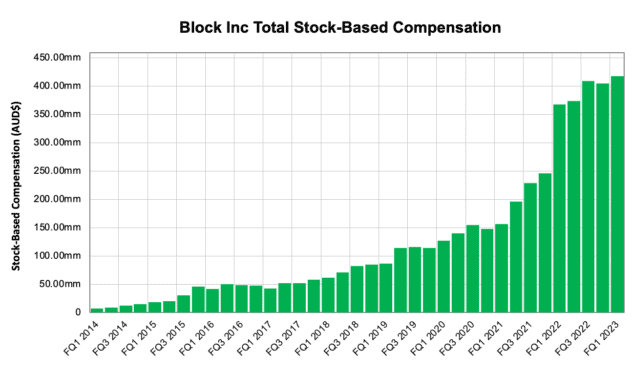

For me, a glaringly obvious piece of baggage that comes along with Block right now is the enormous amount of stock-based compensation (SBC). A total of US$279.59 million (AU$417.69 million) worth of stock-based compensation was incurred in the latest quarter alone.

The company uses this to aid in retaining its talented employees. However, the fact that SBC is rapidly growing over time is concerning, as shown above. Especially when this amount is added back into operational cash flow.

There are differing opinions over the treatment of SBC. Personally, I think it is important to look at cash flow excluding SBC. When doing so, Block’s cash flow from operations in the latest quarter would be a meagre US$14.81 million from US$4.99 billion in revenue.

Overall, that is the biggest ‘must-know’ detail for anyone considering buying Block shares, in my opinion.