How are your mortgage repayments going? What about your ASX stock portfolio?

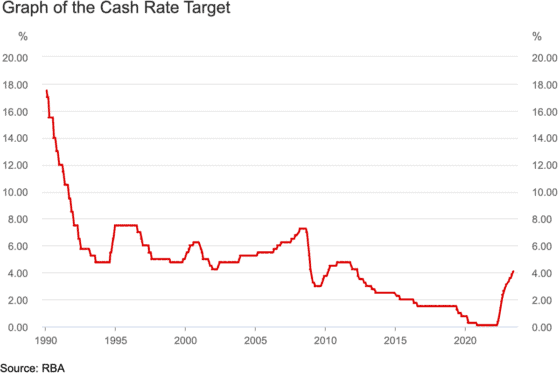

If you feel like you’ve barely had a chance to catch your breath after 12 interest rate rises in 13 months, you’ll not want to hear this.

Yes, it’s that time of the month again.

The Reserve Bank of Australia could be raising its cash rate again on Tuesday afternoon.

So will the central bank pile on more pain for Australians?

50-50 call for the Reserve Bank

A survey of prominent economists conducted by comparison site Finder shows the smallest possible majority (51%) think the RBA will hike the cash rate. The remaining 49% believe it will hold.

Those who think a raise is coming cite Australia’s still-high inflation, strong employment market, and concerns about a wage-price spiral.

While inflation has ticked down from its peak, UNSW Sydney economics lecturer Dr Nalini Prasad pointed out how it’s still raging in absolute terms.

“Inflation is higher than the cash rate. Of particular concern is services inflation which primarily reflects labour costs,” she said.

“To bring this down, the RBA will need to increase interest rates.”

The strong jobs market is discouraging the central bank from giving Australians a break, according to My Housing Market chief economist Dr Andrew Wilson.

“Stubbornly strong and strengthening labour market unaffected by rate rises over [the] past year,” he said.

“Underlying inflation is still too high and significantly above target range. Responsible inflation-fighting policy demands more rate increases.”

Those calling for the RBA to hold are citing how inflation has reduced in recent months and the need to give previous rate rises a chance to filter through the economy.

“Since monetary policy has long lags, now is the time to stop raising the cash rate,” said Macquarie University economics professor Jeffrey Sheen.

“The probability has significantly increased of the economy slowing down — and maybe experiencing a recession — by the end of 2023.”

Could Australia fall into a recession?

And that’s the juggling act for the Reserve Bank.

Inflation needs to be killed off, but the economy could be severely damaged in doing so.

AMP Ltd (ASX: AMP) chief economist Dr Shane Oliver worried last week that Australia now has a very high 50% chance of plunging into recession.

“Because central banks never know when they have raised interest rates enough to control inflation they often go too far, pushing the economy into recession,” he said.

“This was the case prior to recessions in Australia in the early 1980s and 1990s and in the US in the early 2000s and 2008.”

The bad news, if you needed any more, is that even some of the experts who are tipping the RBA will hold the rate in July think there are more hikes to come later.

“The fall in the May monthly CPI figure, as well as other signs that our economy is slowing down, should give the RBA room to keep the cash rate on hold this month at 4.1%,” said Metropole Property Strategists founder Michael Yardney.

“However, it would not reduce the likelihood of one to two more interest rate rises in coming months.”